Our Pools

How They Work

- Members intake is pooled, blended and sorted into homogenised bulks and sold on premium contracts by our marketing partners.*

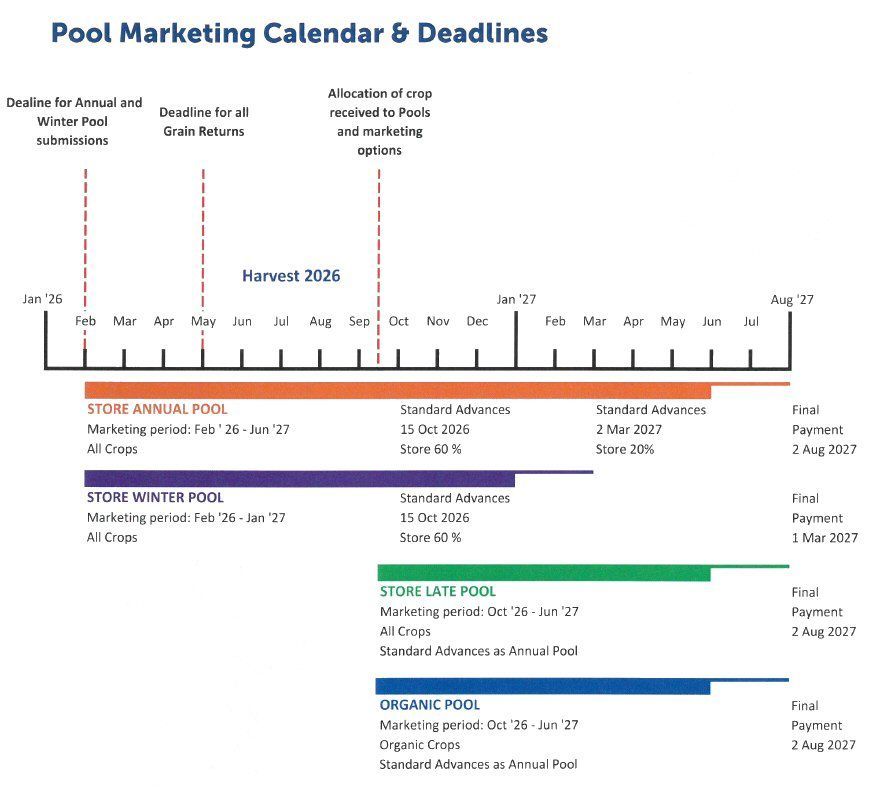

- There are 3 main pools with different marketing periods as shown below.

- Whilst final payment date is 3rd August 2026 members can take advances at any time, once crop has come in to store, within some parameters. The Winter Pool pays out earlier on 2nd March 2026 but won’t have access to the carry premium often available with movements later in the season.

*There are exceptions for Feed Wheat/Feed Barley/Beans and OSR where we allow members to direct market crop as an alternative to allocating to the Camgrain pools

Camgrain Pool Performance

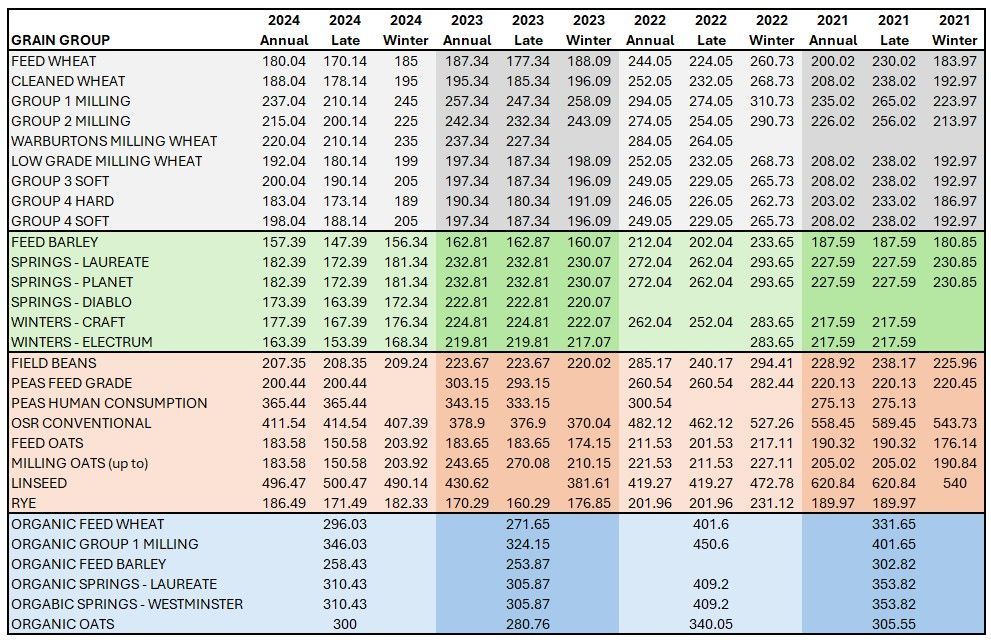

Last FOUR Years

This table illustrates the performance of the Camgrain pools over the past four years, detailing the £ per ton paid to members.

This provides a clear overview of how our pools have delivered for our members, reflecting both market conditions and our collective efforts to maximise value from your grain.

Click here to view our latest Marketing Report that contains details of payments for Annual, Biannual and Late Pools.

Pool Payment Advances

Access Your Cashflow Early

At Camgrain, we understand that cashflow is important to our members which is why we offer the option of advance payments. While the Winter Pool pays out in early March and the Annual and Late Pools in August, members who need access to their funds sooner can request an advance payment.

Standard vs. Non-Standard Advances

There are two types of advances: standard and non-standard, both designed to give you flexibility in accessing your funds when you need them.

- Standard Advances pay out 60% of a base price in early October and 20% in early March.

- Non-Standard Advances allow you to request an advance at any time within the same parameters, with 60% of the base price available by October and up to 80% by March. As we approach the August payout, we can increase this to 100% of the base price, provided there is no risk to the society in doing so.

Note: Advances are typically not made in July.

Interest on Advances

Interest on advances is charged at 2% above the Bank of England base rate - the same rate we are charged by our bank on our overdraft. As we move closer to the August payout, this rate may be reduced as we enter a surplus cash position, giving us more flexibility to pass on the benefits to our members.

The interest costs are deducted from your final pool payment, ensuring that the process remains transparent and manageable for you.

Store and Financial Surplus

At Camgrain, we operate in a unique and transparent way to ensure that our members are protected from the financial risks that have impacted other grain stores. Our co-operative model focuses on the security and value of your grain, and we take every step to keep your interests at the forefront of our operations.

Grain Ownership and Ring-Fenced Accounts

One of the key principles that sets Camgrain apart is that your grain is never 'owned' by Camgrain Stores. Instead, it is kept off-balance sheet, ensuring that it remains in your ownership, even once it's delivered to our storage sites. This is an important safeguard that ensures our members maintain control over their crops.

Additionally, the money received from selling the grain is kept in a ring-fenced bank account within a dedicated entity, Camgrain Ltd. This structure ensures that funds generated from the sale of grain are handled separately and securely, further protecting our members' interests.

The Surplus: What It Means for You

At the end of each crop year, following the completion of the pool process in August, Camgrain Ltd will distribute a surplus to each member who delivered grain into the Camgrain pools. This surplus will be paid on a per ton basis, ensuring that the value is shared equally among all members who have marketed their crops through our collective pool arrangements.

The surplus itself is made up of two components:

- Financial Surplus: This is derived from the excess of interest charged to members for advance payments, less the net interest costs and overdraft fees charged by our banking partner. Essentially, it reflects the value generated from managing our members' financial transactions.

- Store Surplus: This is the income derived from selling any store surplus - amounts in excess of the stored weights. This surplus arises when Camgrain, as a grain store, has not lost all the throughput or other weight loss deductions (such as drying and ergot cleaning processes). Essentially, if we’ve successfully managed the storage and handling processes and achieved a higher-than-expected yield, that value is passed back to you.

Returning Value to Members

This surplus distribution is a core aspect of the Camgrain co-operative model. All the value generated from these surpluses is returned to our members, reinforcing the true co-operative ethos that drives our business. It’s our way of ensuring that our members not only benefit from a reliable, secure grain storage service but also share in the financial successes of the co-op.

By keeping your grain in your ownership, offering transparency in how we handle and sell it and sharing any surpluses equitably, we strive to create a fair and valuable experience for all of our members.

Direct Market / DES

Direct Market Option

For Feed Wheat, we are combining the DES and Direct Market options this year on the Grain Returns.

DES stands for Direct Exchange Sale. Members have the flexibility to decide how to sell their non pool feed wheat after it comes in to store. They can sell on the futures exchange, to the marketing partner or to other third parties on an ex-Camgrain store basis.

Other feed products can also be sold on an ex-store basis to third parties.

For 2026 the Direct Market/DES fee is reduced to £3 p/t.

The fee is waived when the feed wheat is sold on the November 2026 contract.